- Published on

Market Alert: Navigating Bullish Gaps and Fibonacci Targets

- Authors

- Name

- Michael W. Clark

- @MichaelW_Clark

Market Alert: Navigating Bullish Gaps and Fibonacci Targets in NQ and QQQ

As the dawn breaks on April 1st, 2024, the trading world eyes the significant bullish gaps witnessed in the NQ and QQQ charts. These gaps, markers of potential strength, present us with strategic points of interest guided by Fibonacci levels.

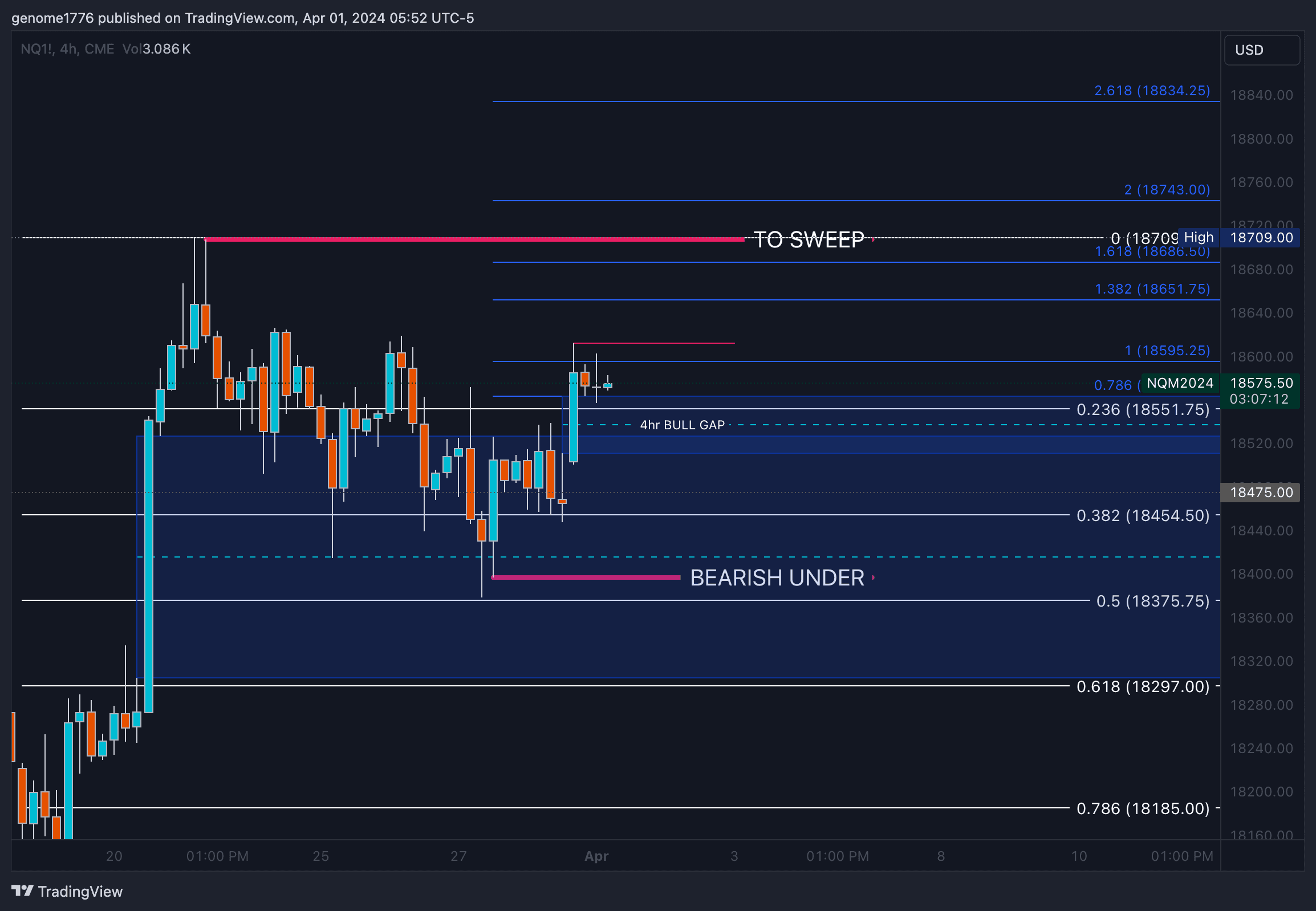

NQ Analysis: Embracing the Bullish Gaps

The NQ index, after holding the middle of a substantial 4-hour bull gap, showcased a pre-market surge, affirming our bullish outlook. Our strategy revolves around capitalizing on this momentum, with our eyes firmly set on key Fibonacci extensions above current levels.

NQ Bullish Targets:

- 1 Fibonacci: 18595.75 (unbroken)

- 1.382 Fibonacci: 18651.75

- 1.618 Fibonacci: 18686.50

- 2 Fibonacci: 18743.00

Building upon the large 4-hour gap observed this morning, our primary goal is to identify long positions emerging from this gap, aiming for the Fibonacci levels mentioned. Although failure to breach the 1 Fibonacci level could indicate a potential downside, the current market structure encourages a bullish stance, supported by nested bullish gaps.

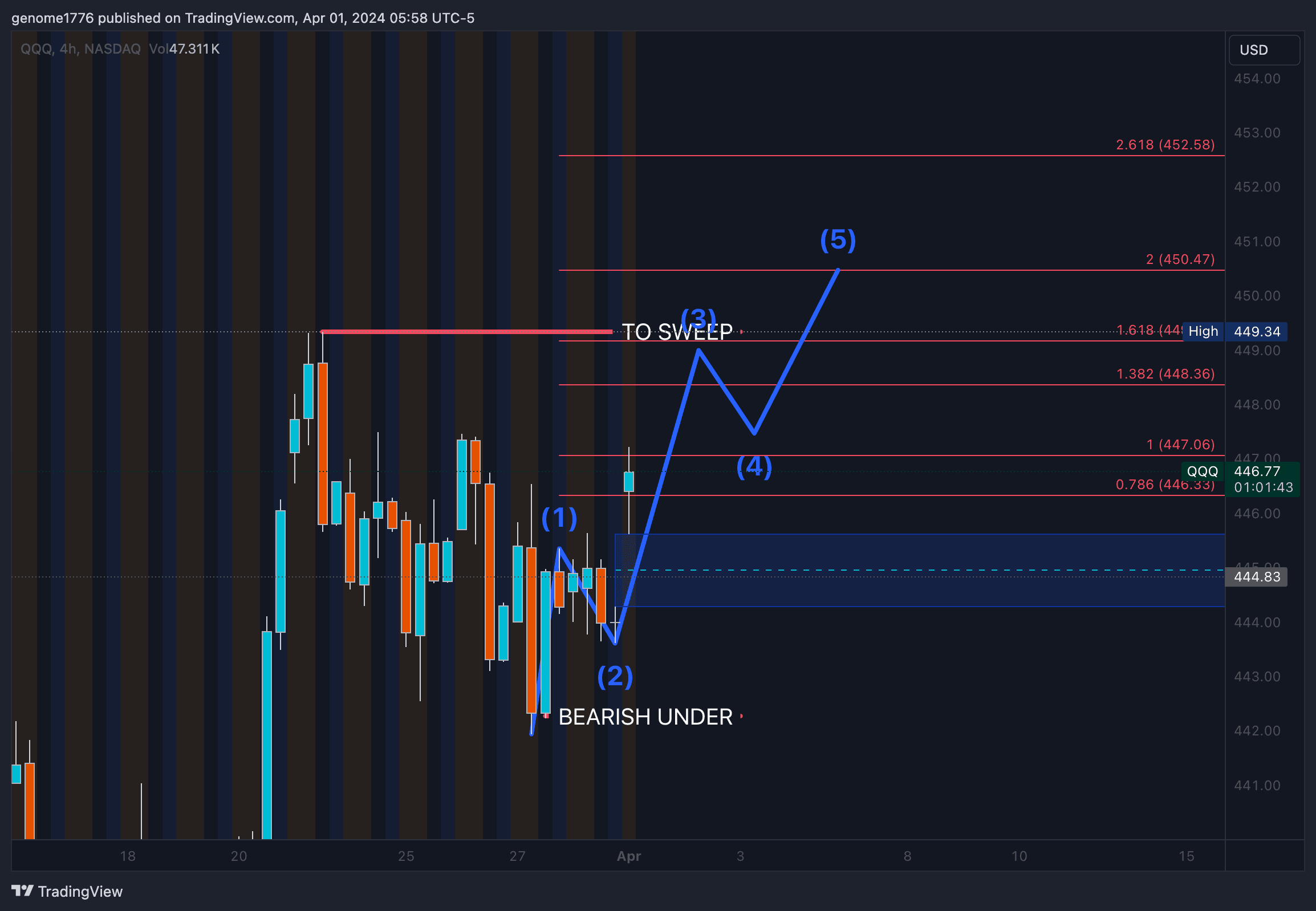

QQQ Analysis: Fibonacci Levels as Beacons

Similarly, QQQ mirrors the setup seen in NQ, with Fibonacci levels drawing a roadmap for potential long positions. The identification of a significant gap sets the stage for a bullish narrative, provided the market sustains its current trajectory.

QQQ Key Fibonacci Levels:

- 1 Fibonacci: 447.06

- 1.382 Fibonacci: 448.36

- 1.618 Fibonacci: 449.17

- 2 Fibonacci: 450.47

Our strategy hinges on harnessing the momentum out of the gap's midpoint or a complete gap fill, approximately around 444.28, steering our trades towards the outlined Fibonacci targets.

Today’s Trading Outlook

Strategy Focus:

- For NQ: The morning's bullish gap lays the groundwork for our long positions, with a vigilant eye on the Fibonacci extensions for exit points.

- For QQQ: Similar to NQ, we look to exploit the bullish sentiment, targeting key Fibonacci levels from the gap’s influence.

Market Cautions:

Despite the bullish indicators, maintaining a cautious approach is paramount. The failure to surpass the initial Fibonacci level (1 Fib) in NQ could signal broader market implications, necessitating a readiness to pivot strategy based on real-time market feedback.

Conclusion

Today marks a critical juncture for traders focused on NQ and QQQ, with bullish gaps offering a fertile ground for strategic positioning towards Fibonacci extensions. In aligning our trades with these technical landmarks, we embrace the market's volatility, guided by a disciplined approach to capturing the momentum's essence. As always, vigilance and adaptability will be our companions on this journey through the trading day.