- Published on

QQQ and NQ on an Unexpected Path

- Authors

- Name

- Michael W. Clark

- @MichaelW_Clark

QQQ and NQ on an Unexpected Path

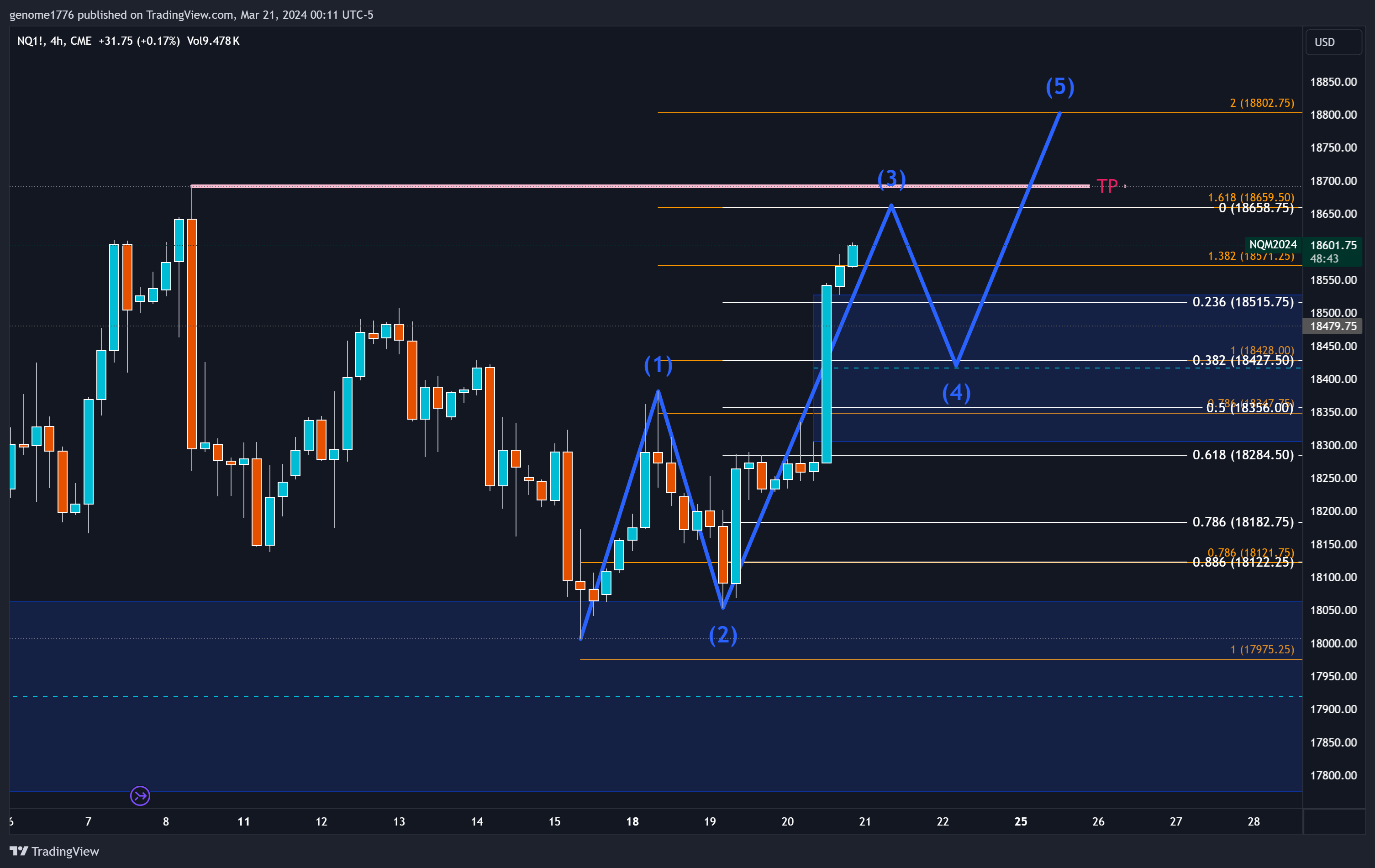

QQQ and NQ's market movements recently caught many by surprise, myself included, as they surged past key Fibonacci levels, suggesting a robust upward momentum. This analysis aims to shed light on these developments and outline potential strategic approaches moving forward.

Market's Unpredictable Nature

The expectation for a tap at the 1 fib level at 431.28 for QQQ, mirrored by NQ, was upended as the market took a decidedly bullish turn. This unpredictability serves as a reminder of the constant need for adaptability in trading strategies.

Observations:

- Bullish Gaps: Both QQQ and NQ have shown significant bullish gaps, introducing new dynamics to consider.

- Fibonacci Focus: Current market attention is centered around the 446.76 level for QQQ and 18659.50 for NQ, guiding our analysis and strategy formulation.

Key Fibonacci Levels

For QQQ:

- 1.618 Extension: expected to hit 446.76 above is our fully bullish confirmation.

- 2 Fibonacci Extension: Found at 449.92, a potential resistance or breakout point.

Retracement Expectations for QQQ:

- .238 Retracement: Positioned at 443.59, often the initial short target.

- .382 Retracement: At 441.63, marking the secondary short target.

- .5 Retracement: At 440.04, also a valid target. Breaking the .382 might lead here.

- .618 Retracement: At 438.46; dropping below could suggest a bull trap, potentially sweeping lows towards 430.88.

For NQ:

- 1.618 Extension: Marked at 18659.50, indicating a strong upward drive.

- 2 Fibonacci Extension: Located at 18802.75, another key point for possible resistance or upward continuation.

NQ's Expected Retracement:

- .238 Retracement: First short target at 18515.75.

- .382 Retracement: Secondary short target at 18427.50.

- .5 Retracement: A valid retrace point at 18356.00. A dip below .382 might reach this.

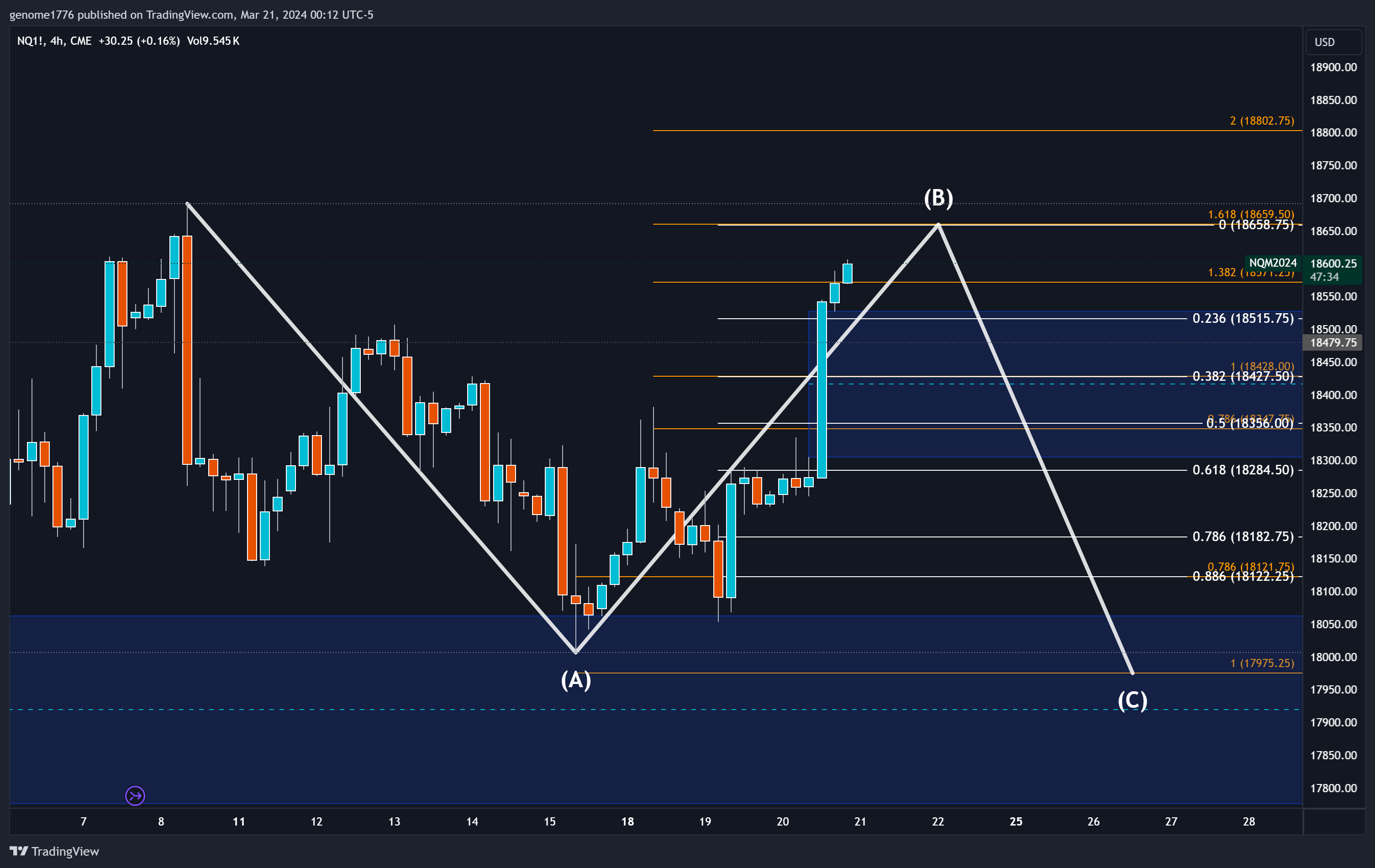

- .618 Retracement: At 18284.50; falling beneath this level hints at a bull trap, possibly leading to a sweep of lows towards 17975.25.

Planning for Tomorrow

Strategy Essentials:

- Volume Watch: Key is observing high volume near the fib targets, indicating potential short setups amidst the bullish gaps.

- Positioning: Consider flipping to long on strong volume indicators with significant price rejections at key levels.

- Retracement Plays: If the surge halts at these Fibonacci levels, looking for retracement entries could be lucrative, albeit with caution near all-time highs.

Strategic Mindset:

- Navigating Gaps: The focus is on shorting into strength with an eye on the market's response.

- Adaptability: Being ready to pivot based on real-time volume and price action insights.

- Highs Awareness: The significance of all-time highs cannot be overstated, demanding strategic flexibility.

Cautionary Note on Bearish Possibilities

While bullish indicators prevail, the 1.618 extension could culminate a C leg of a broader B wave in a downward 3-wave pattern. This scenario, though not primary due to the bullish gaps, warrants attention. A downturn from here could lead to a retest of recent lows before a genuine ascent to new highs.

Conclusion

The current behavior of QQQ and NQ highlights the critical need for flexibility and vigilance in trading. As we focus on Fibonacci levels and market responses, our strategies must remain dynamic, ready to capitalize on opportunities or mitigate risks as the situation evolves. This journey through the markets promises both challenges and rewards, with strategic foresight being our guiding principle.