- Published on

Short META

- Authors

- Name

- Michael W. Clark

- @MichaelW_Clark

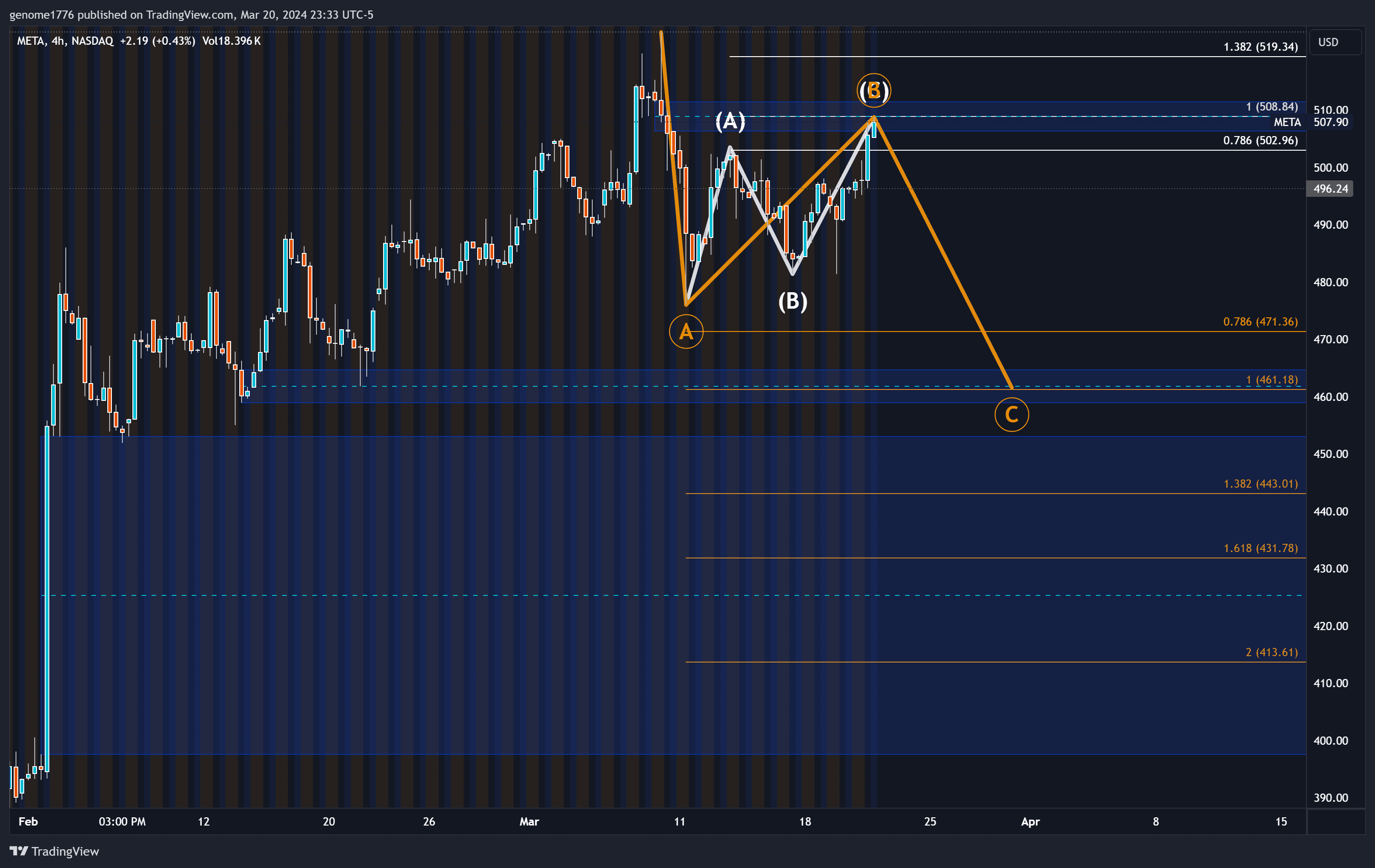

📉 Shorting META: A Strategic Trade Setup 🎯

The dynamic world of trading constantly presents unique opportunities, and today's focus shifts to META, a stock showing signs of a pivotal setup. By harnessing the synergy of Fibonacci extension, Fair Value Gap (FVG), and options strategies, we uncover a compelling short trade idea.

🔍 Trade Idea Overview:

META's price action offers an intriguing setup:

- Failing Point: META failing at the 508.84 mark.

- Technical Confluence: This level is significant due to its identification as a 1 fib extension and a 4-hour FVG.

- Risk-Reward: The R:R is favorable, you can cut with a 15m candle close above 508.84 or above 519.34 depending on your risk tollerance. Above 519.34 I'll consider this invalid.

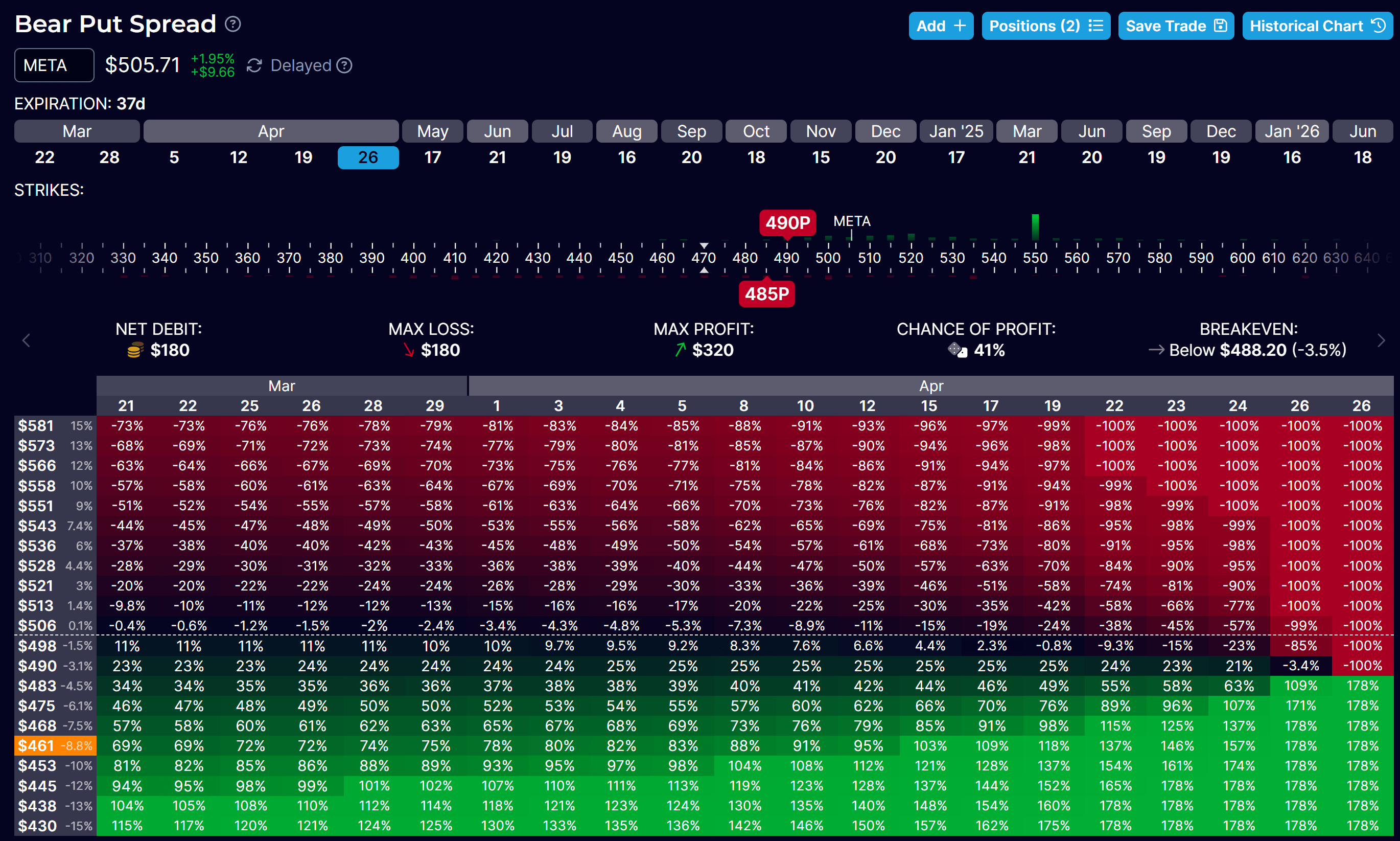

Options Strategy: Put Debit Spread

- SELL: 485P for April 26

- BUY: 490P for April 26

- Max Loss: Approximately 17%

- Max Gain: Up to 178% if META closes under 490 after April 26. However, targeting a 50-60% gain by potentially cutting the position earlier.

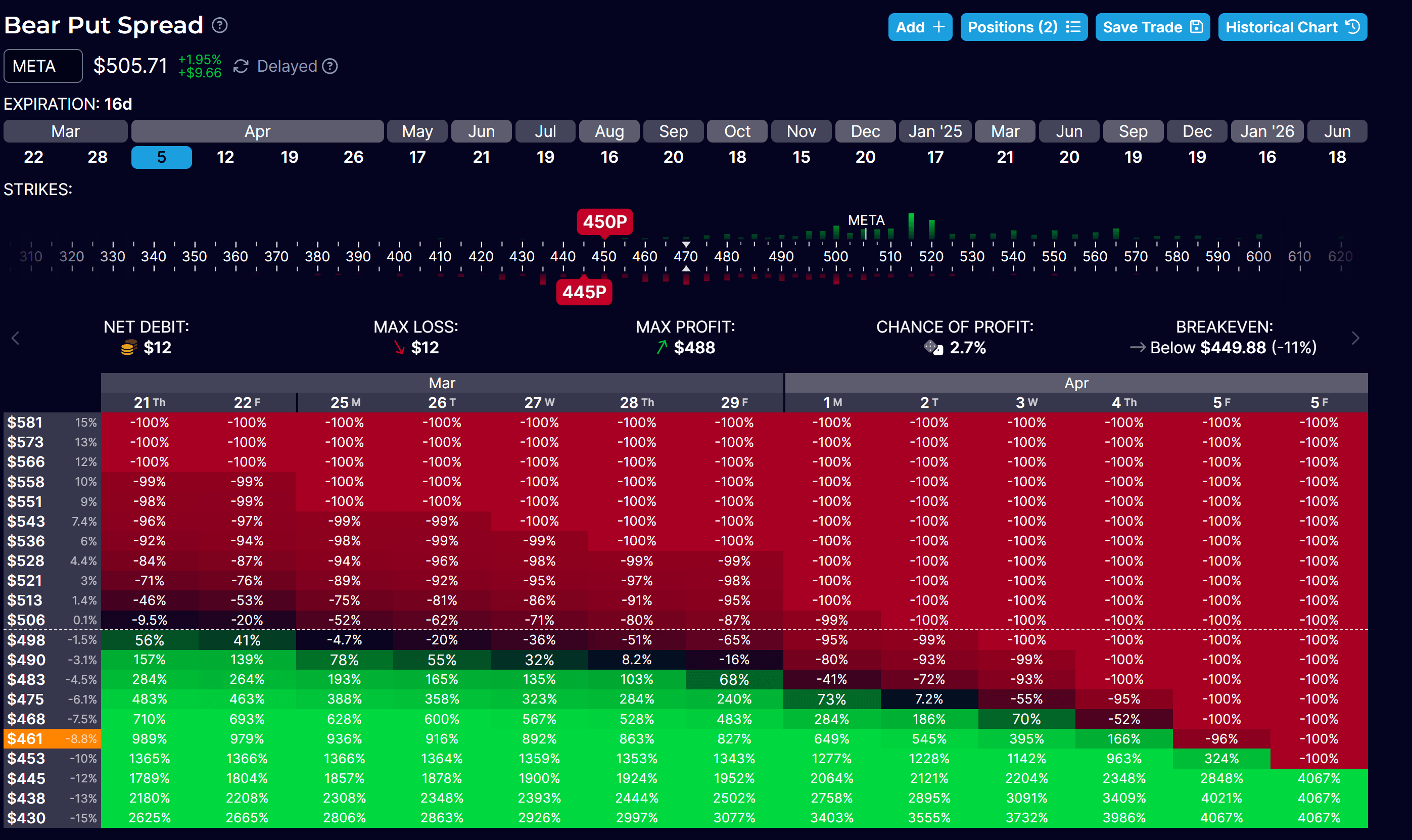

For those with a higher risk appetite, a closer dated option for April 5th is suggested, which entails higher risk and reward.

📈 Thesis Rationale:

- Wave Structure: We observe a 3-wave movement from the recent low, extending to a 1 fib extension pivot point.

- Technical Zones: The 1 fib pivot aligns within a 4-hour gap, marked by two distinct gaps in the chart.

🖼️ Visual Insights:

- Options Trade Profitability for April Setup:

- Options Trade Profitability for March Setup:

💥 Bonus YOLO Section: March 5th Play For the ultra-risk-tolerant traders, consider the March 5th 445/450 put debit spread. Entry at $12, this play targets a significant flush to the 430 level, offering a potential 4000% gain if META is under 445 by March 5th.

Hedging Through Shorter-Dated Calls

Acknowledging the possibility that META could initiate a new upward trend, I intend to incorporate a straightforward hedging strategy. This involves purchasing shorter-dated calls as a form of protection. This tactic is aimed at safeguarding against potential upward movements in the stock's price while maintaining our primary short position.

The key advantage of using shorter-dated calls for hedging is their cost-effectiveness compared to longer-dated options, coupled with the flexibility they offer in rapidly changing market conditions. Should META's price begin to rise, these calls can help offset the losses from our primary position. Conversely, if the expected downward movement materializes, the loss from these protective calls remains limited and manageable.

This hedging approach underscores a prudent risk management strategy, allowing us to stay positioned for our anticipated move while being prepared for unexpected shifts in the market direction.

Conclusion: This META short setup illustrates the power of integrating technical analysis, specifically Fibonacci extensions and FVGs, with sophisticated options strategies. Such a multi-faceted approach not only enhances the precision of the trade but also optimizes the risk-reward profile.

Remember, every trade carries risk, and it's crucial to manage your risk according to your trading plan and risk tolerance. Happy trading, and may your decisions be informed and your trades prosperous!