- Published on

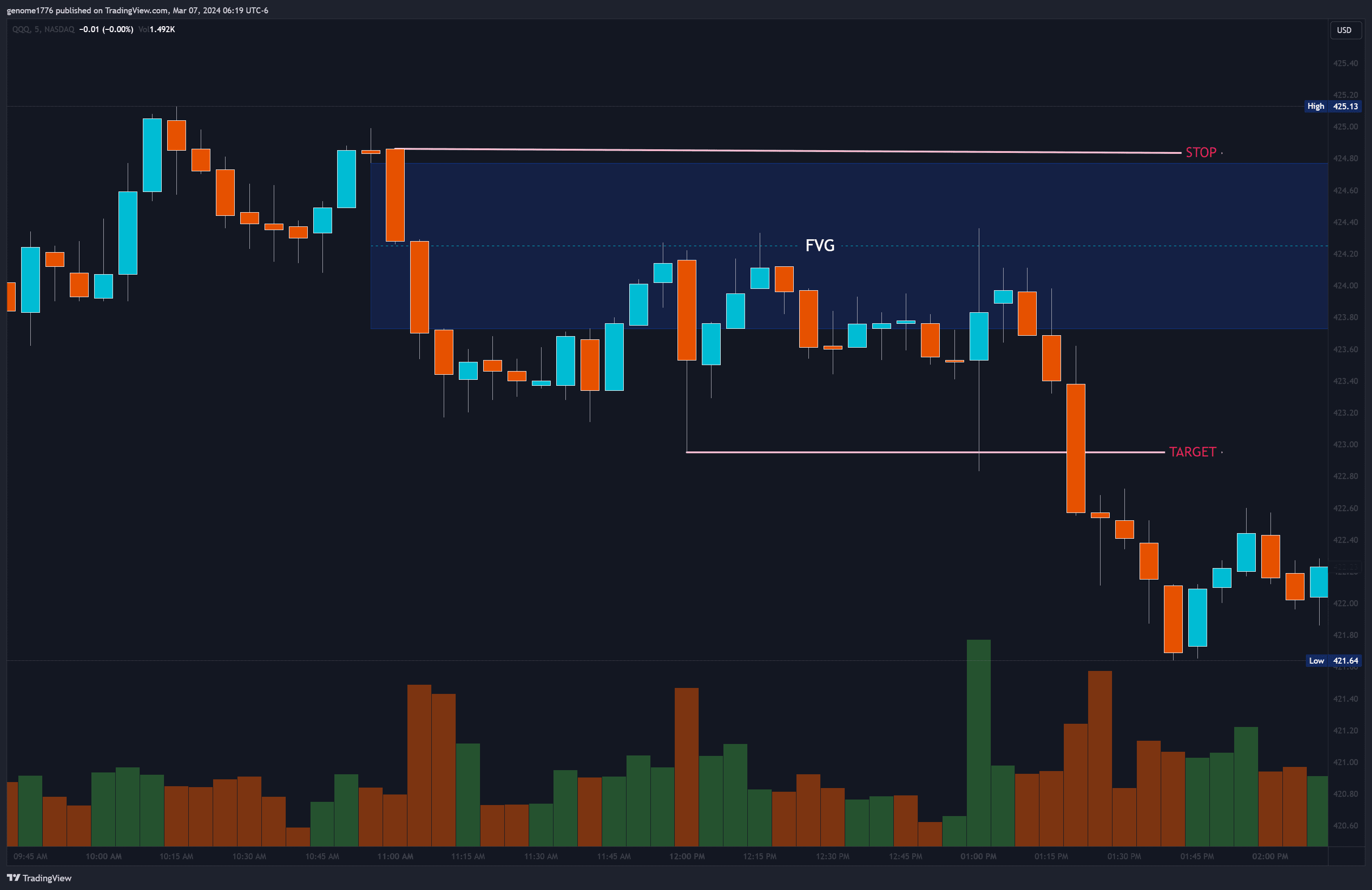

Using FVG to Identify Potential Pivots

- Authors

- Name

- Michael W. Clark

- @MichaelW_Clark

🚀 Capitalizing on Fair Value Gaps for Precision Trading 🔄

In the intricate world of trading, identifying clear and actionable entry and exit points is crucial for success. The concept of Fair Value Gaps (FVG) stands out as a powerful tool for traders aiming to pinpoint potential pivot points in the market. An FVG occurs when there is a noticeable gap between the price bars on a chart, indicating an area where no trading took place, but which the market deems necessary to revisit.

🔍 Strategy Insights:

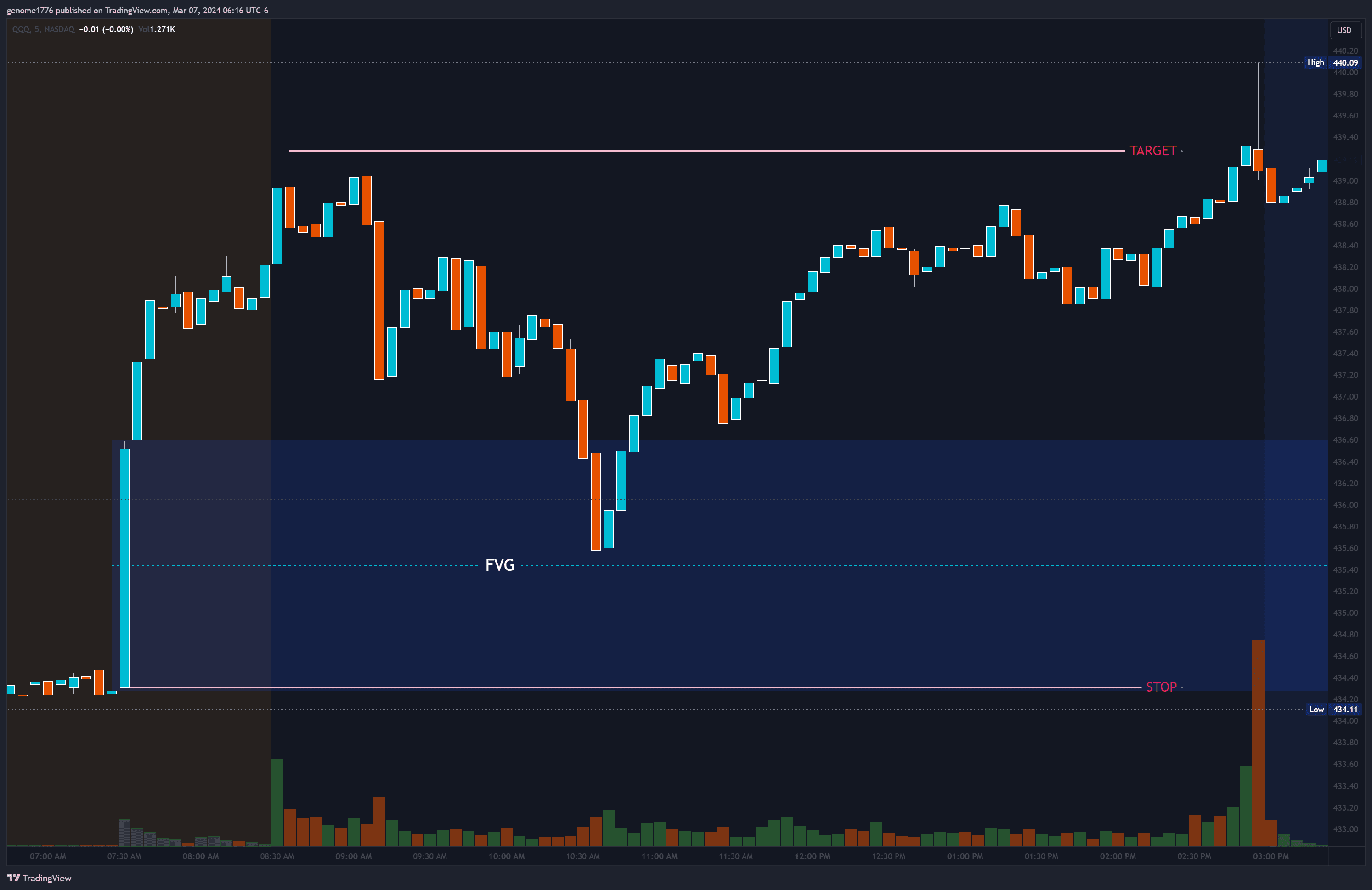

Definition and Importance: An FVG represents an imbalance in price action where the market has moved too swiftly, leaving behind a 'gap'. These gaps are crucial because they often act as magnets for future price action, offering high-probability entry points for traders.

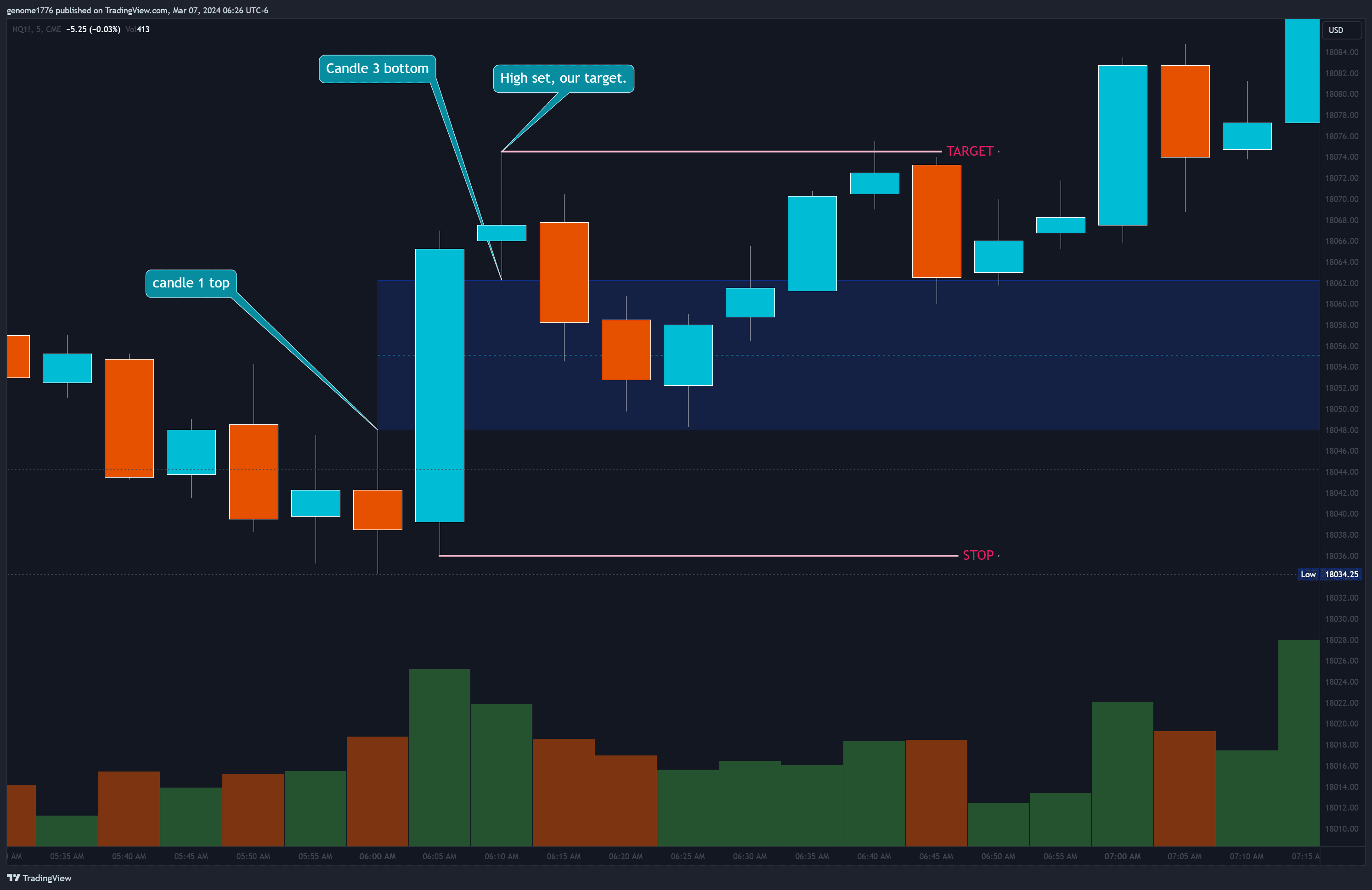

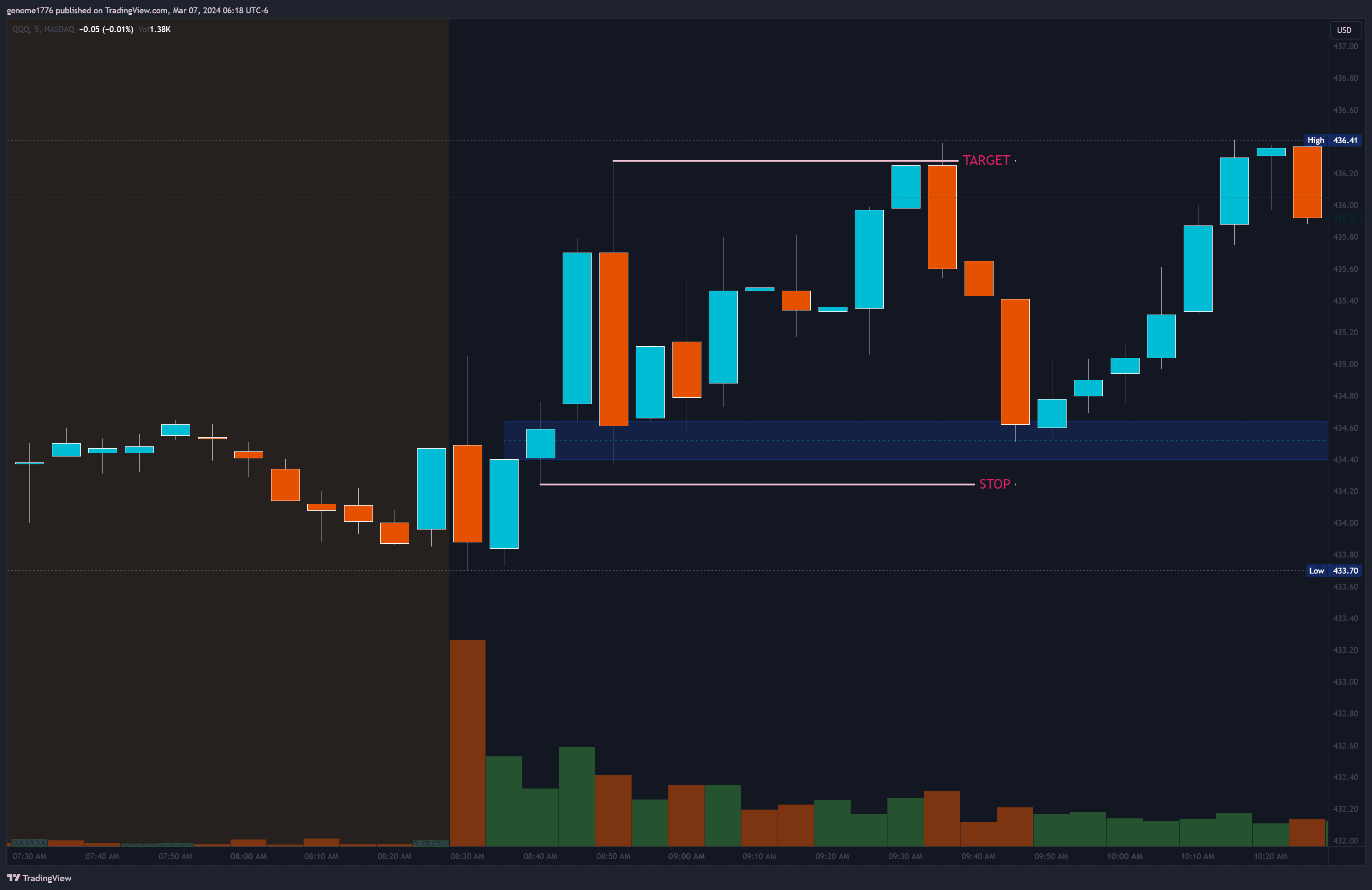

Detailed Formation: Typically, an FVG is formed over three candles. The high of the first candle and the low of the third are separated by this gap, clearly delineating the area void of trading. This visual gap between the high of candle one and the low of candle three marks the fair value gap, providing a clear target for traders.

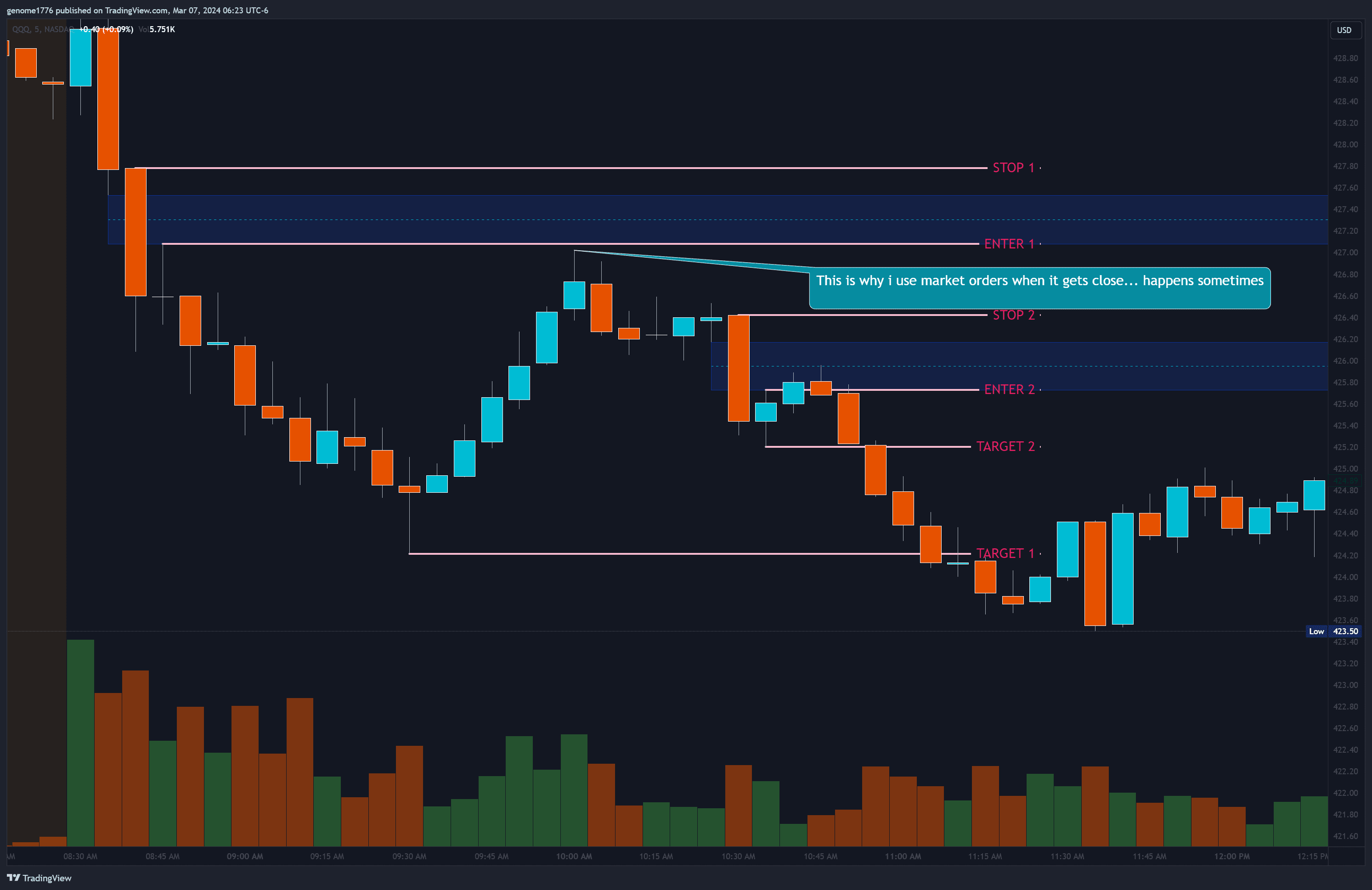

- Entry Strategy: The optimal entry point is at the start of the gap. This means initiating a trade at the edge of the gap where the market moved away, anticipating that the price will return to 'fill' this gap.

Stop-Loss Placement: The stop loss for this strategy should be placed just beyond the candle that created the gap, providing a clear risk management parameter.

Profit Targets: The target for taking profit should be set at the opposite end of the gap, expecting the price to not only enter the gap but also to sweep through it, covering the entire gap area.

- Integration with Other Strategies: While powerful on its own, combining FVG analysis with other trading strategies like Fibonacci retracements, Elliott Wave theory, or even simple support and resistance levels can significantly enhance the precision of entries and exits. This multi-strategy approach can lead to a more robust trading system, offering clearer signals and better risk management.

🛠️ Identifying FVGs: Spotting an FVG requires a keen eye on price action and chart patterns. Typically, these gaps are easier to identify in markets with high volatility and volume, where rapid price movements are more common. By closely monitoring the charts, traders can spot these gaps and prepare their strategies accordingly.

🎯 Conclusion: Fair Value Gaps offer traders a unique opportunity to exploit market inefficiencies for potential profit. By understanding how to identify and trade these gaps effectively, traders can enhance their strategy with precise entry and exit points, leading to improved trading outcomes. Pairing FVG trading with other analytical tools and strategies can further refine this approach, turning market gaps into profitable trading opportunities.

Happy trading!