- Published on

Market Alert: CPI Impact and Fibonacci Levels

- Authors

- Name

- Michael W. Clark

- @MichaelW_Clark

Market Alert: CPI Impact on QQQ and SPY

Following the March 5th uptrend, today's market faces a critical moment as QQQ and SPY react to the recently released CPI data. With inflation figures coming in hot, we're positioned at key Fibonacci retracement levels that may dictate the market's short-term direction.

QQQ Analysis: Responding to CPI Data

QQQ's response to the CPI release has it touching the .786 Fibonacci extension, a move mirrored in larger timeframe analyses. Today's pivot points for a bearish stance are as follows:

QQQ Bearish Pivots:

- In: 441.02

- Pivots: 442.09, 442.04, 443.59, 444, 445.17, 445.81

- Bullish Above: 447.13

QQQ Downside Targets:

- Should we confirm today's high as the peak, the following levels will be our focus: 428.14, 423.10, 419.99, 414.95, 406.80.

Caution Advised:

With CPI figures exceeding expectations, it's wise to approach today's market with heightened caution. Strategy should favor smaller plays to avoid getting caught in adverse movements.

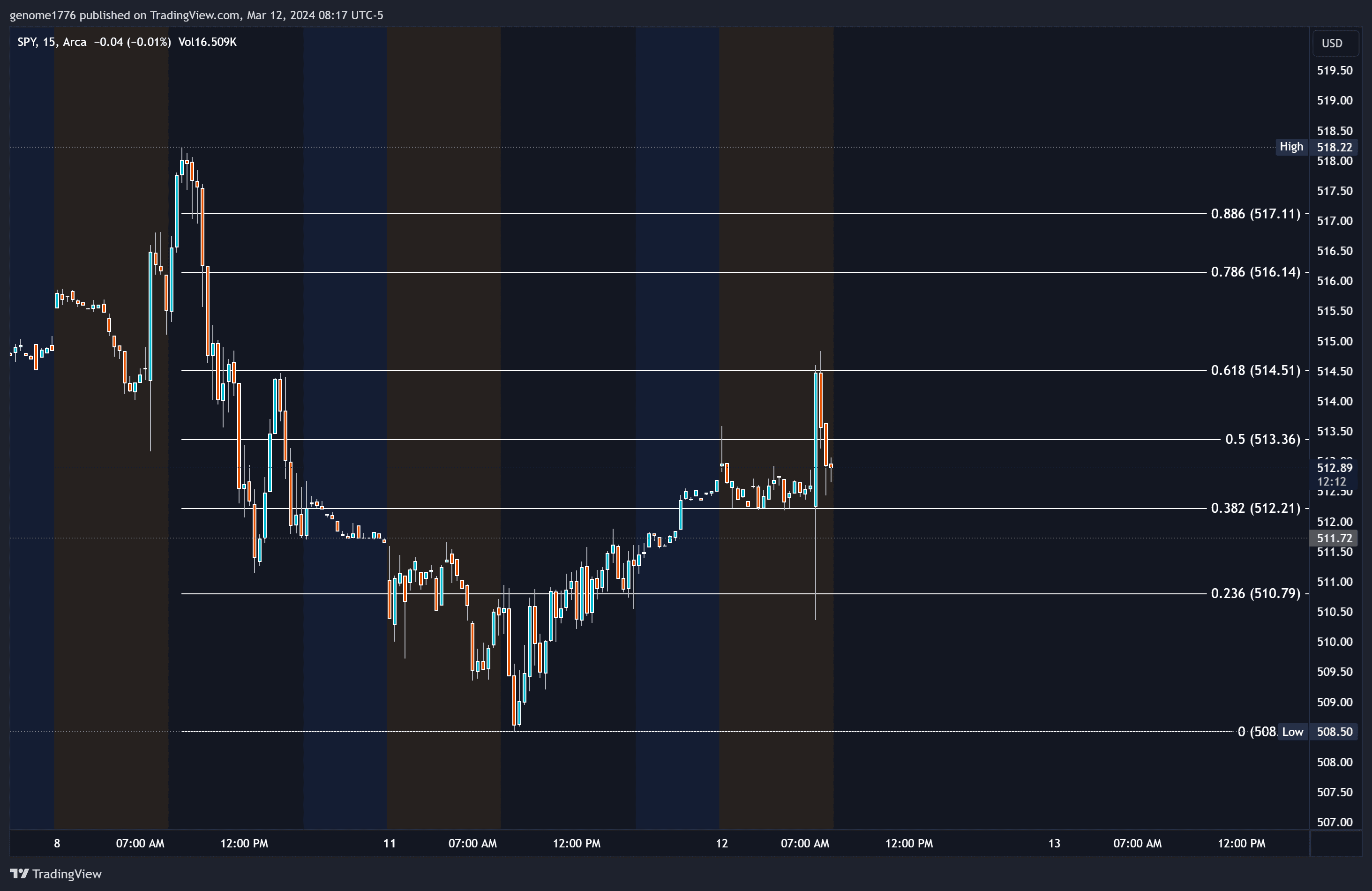

SPY Analysis: Fibonacci Retracement Insights

SPY's reaction aligns closely with QQQ, hitting the 1 Fibonacci extension level, which further emphasizes the similarities to larger timeframe retracements.

SPY's Key Levels and Strategy:

In light of the CPI data, maintaining a cautious strategy is paramount. A bullish outlook is advised only above 517.11, with a keen eye on the market's ability to sustain above this threshold.

Downside targets 505.11, 501.40, 499.10, 495.39, 489.38 (if high is in and we are bear starting extention)

Today's Trading Strategy

Initial Strategy:

Early observations will determine our ability to move away from these critical pivot levels. Given the CPI's impact, the market may exhibit either a new wave down or the start of a new upward trend, but until we break the .886 I have to consider this a retrace of the prior downtrend last week.

Strategic Responses to Market Conditions:

- Topside Gap Reaction: Watch for reactions to the topside gaps in QQQ and SPY. Strong reactions may offer short opportunities targeting the .618 level.

- Monitoring Downward Movements: Continue to observe how the market interacts with the lower Fibonacci levels for potential long scalps, using Volume Price Analysis (VPA) and identified gaps as guides.

Risk Considerations:

Given today's CPI data, risk management takes precedence. Trading plans should be adjusted to account for increased volatility, emphasizing smaller position sizes and heightened caution.

Conclusion

Today's market, influenced by surprising CPI figures, places QQQ and SPY at a juncture highlighted by critical Fibonacci levels. Our strategy centers on careful observation and a cautious approach, ready to adapt to the unfolding narrative. With the potential for both retracement and new upward trends, our market engagement must be both vigilant and flexible, navigating through today's unique challenges with strategic foresight.