- Published on

MAR 8 QQQ/NQ Projections

- Authors

- Name

- Michael W. Clark

- @MichaelW_Clark

🚨 Market Update & Strategy 🚨

Good morning! Yesterday, we skillfully navigated the market's volatility, leveraging the FVG in the morning to secure profitable call positions and NQ longs across the board.

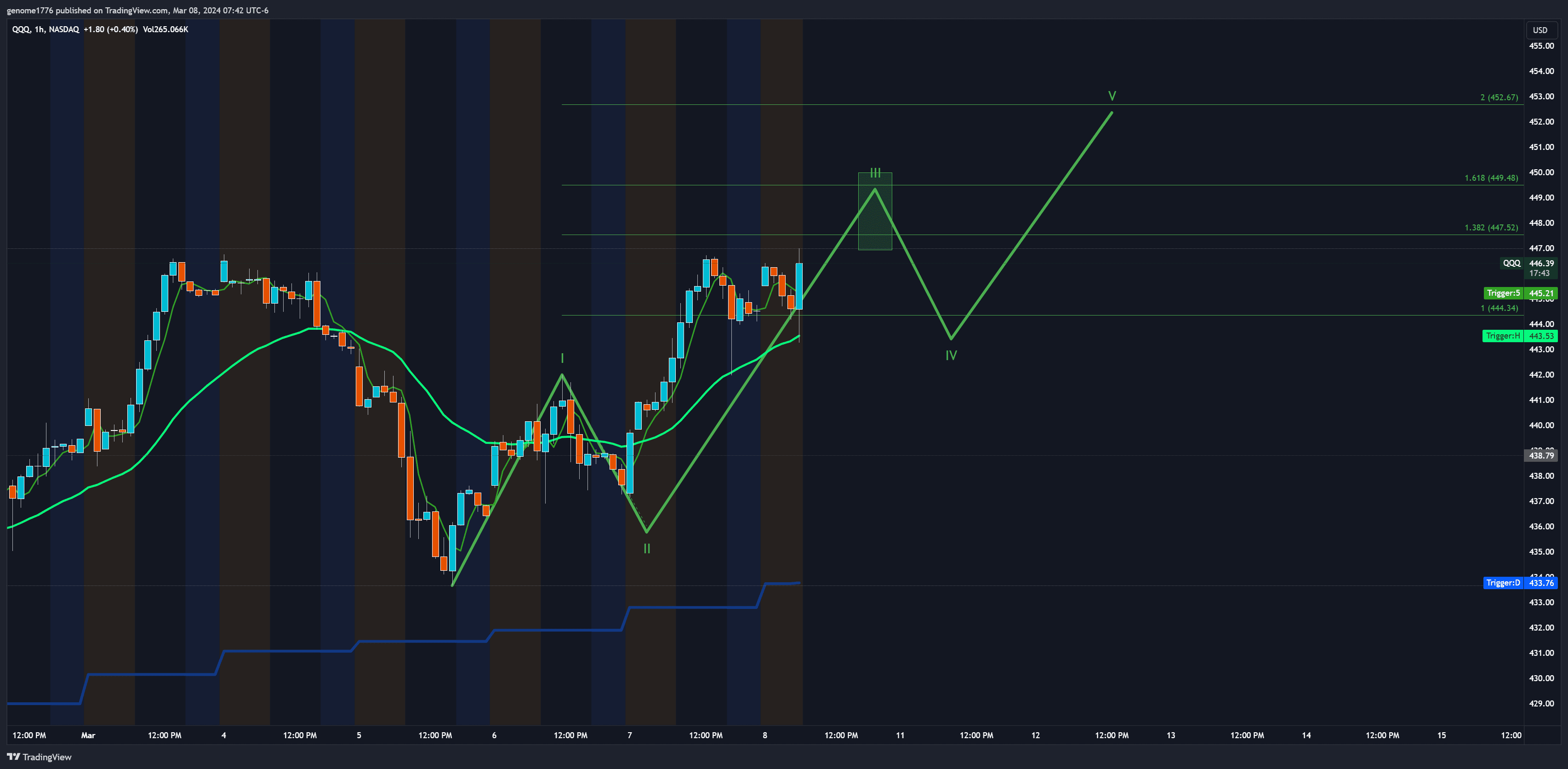

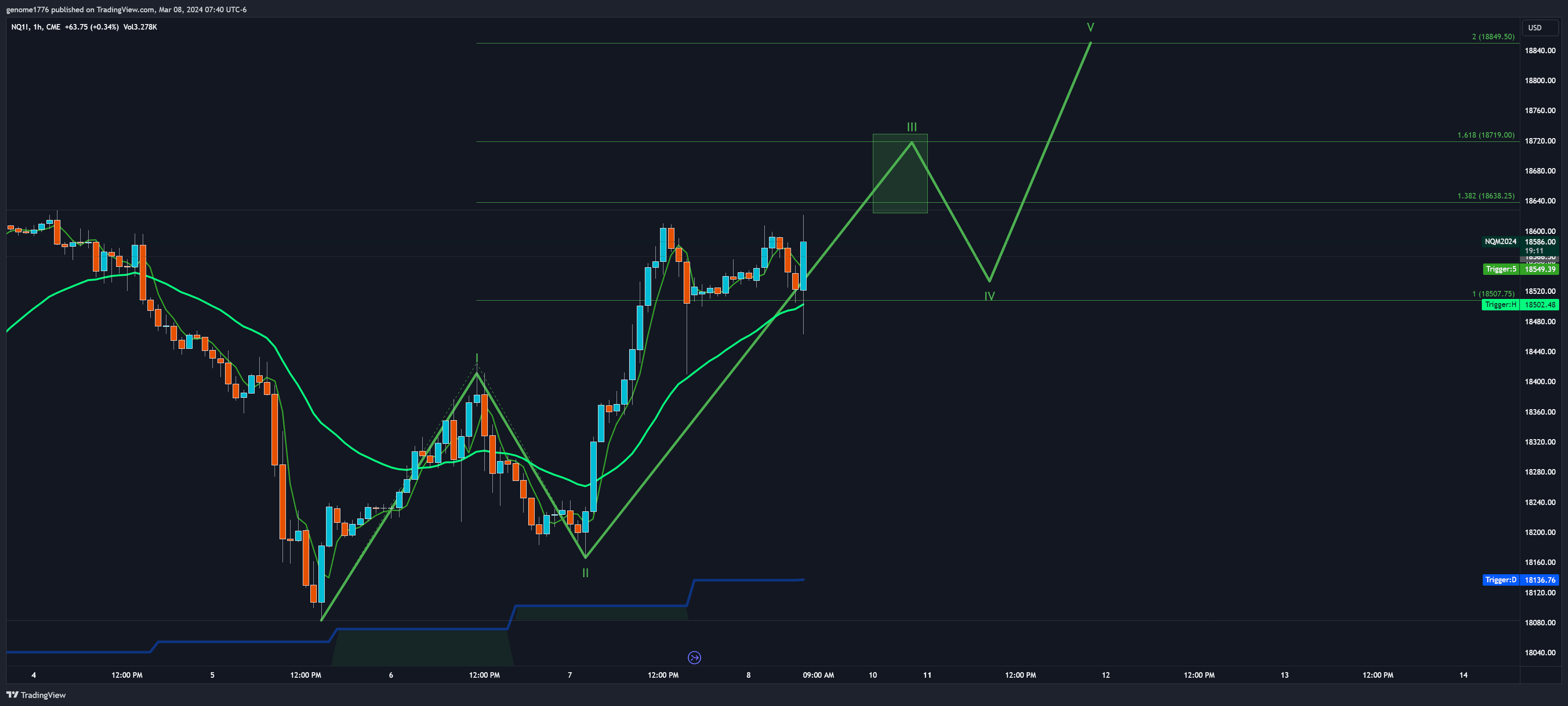

Today, our attention shifts towards the potential conclusion of either wave 3 or wave C, depending on the analysis. We're anticipating some volatility, possibly encountering a sharp move at the Fibonacci extensions between 1.382 and 1.618. The highs of this morning have been swept, indicating a possibility for continuation or rejections above.

Since it's Friday, expect trading to be lighter with a single significant move followed by a day of choppiness and tightening price action (PA).

📊 Key Fibonacci Levels for Today:

NQ (Nasdaq):

- 🟢 1.618 Extension: 18719

- 🟢 1.382 Extension: 18638.25

QQQ:

- 🟡 1.618 Extension: 449.48

- 🟡 1.382 Extension: 447.52

A deeper retracement than initially expected could materialize, especially considering our position in wave 5. A retrace to around 440-441 is conceivable. The exact depth of this potential retracement remains uncertain; thus, close observation of the wave patterns is essential.

Should we breach below 435, the bearish outlook intensifies, with a downward push towards the daily trigger at 433. This level is notably significant, given the convergence of multiple data points suggesting a potential final flush. Bulls, be wary.

📈 Strategy for Today: Given the current landscape, it's prudent to trade lightly, focusing on the early significant move. Pay close attention to how the market interacts with the 1.382 and 1.618 Fibonacci extensions for cues on the day's direction. Be prepared for potential abrupt shifts in market sentiment and adjust positions accordingly.

⚠️ Caution: Today's market could present a mix of opportunities and traps. Position sizes should be managed conservatively, and strategies should be flexible to adapt to the unfolding wave patterns and extensions. For those with limited day trades available, it may be wise to await clearer trend confirmation before engaging.

💡 Positioning: Continuously assess the market's reaction to the Fibonacci levels mentioned above. The plan involves potentially taking positions based on the market's response to these critical levels, with a readiness to pivot should the bearish scenario gain traction.